7 Things to Do When Stocks are CRASHING

1/ Stay away from margin 🎰

Investing on margin involves borrowing money from a broker to purchase stocks. Buying stocks with the money you DO NOT HAVE! That might look appealing to juice up your returns, but it works the other way, too. Too many people got blown up by using leverage.

Don't be one of them.

If you bought stocks with $10k of your own money and $10k on margin, and the stock drops just 25%, you lost $5k - that's 50% of your money. What are you going to do next? Hope it recovers, or rather sell to make sure you return the borrowed money to your broker and don't get margin called? That's a nasty situation to be in! AVOID AT ALL COST.

It can seem tempting during bullish markets, it carries significant risks. A market downturn can trigger margin calls, where the broker demands repayment of the loan, often at the worst possible time. This can force you to sell investments at a loss, potentially wiping out your portfolio. For most investors, especially those who are not seasoned professionals, staying away from margin is a prudent choice to avoid undue financial stress and risk.

2/ Buy great companies 💪

Investing in high-quality companies with strong fundamentals is a cornerstone of successful long-term investing.

Great companies typically have a robust competitive edge, consistent revenue growth, strong management, and a solid financial position. By focusing on these businesses, you position yourself to benefit from their sustained performance and potential for growth.

Over time, these companies often deliver superior returns, weather market volatility, and provide a more reliable path to wealth accumulation. Identifying and investing in such companies requires thorough research and a keen eye for business quality and market potential.

Here is my post on X on 20+ things you ABSOLUTELY MUST UNDERSTAND to recognize great companies -

3/ GVD (Growth-Value-Dividend) 🌱

Great investor CANNOT be one-trick-pony. There are times when it is awesome to load up on cheap growth stocks, there are times when proven value companies are unloved and discounted and there are also times when those sweet sweet dividends come to rescue.

The market presents different opportunities, back in late 2023, I was loading up on META under $100/share or PLTR below $10 - and sure, they might still be a DECENT BUY, but if you understand valuations in depth, you can strike when the opportunity comes. And strike decisively. There were members of my Private Group buying discounted growth stocks and they've seen their portfolios take-off FAST. But the year is now 2024, and different companies are "steal-deal" now...and next year it will change again.

And so you MUST understand different companies, different industries. Software company is trading at a different multiple than a manufacturer or retailer. And growth stock in early stages of profitability might be a SCREAMING BUY at 60 PE ratio, but paying the same multiple for mature company would be a total RIPOFF!

Know the difference.

4/ Avoid getting lured into short term trading. Focus long term ⏱️

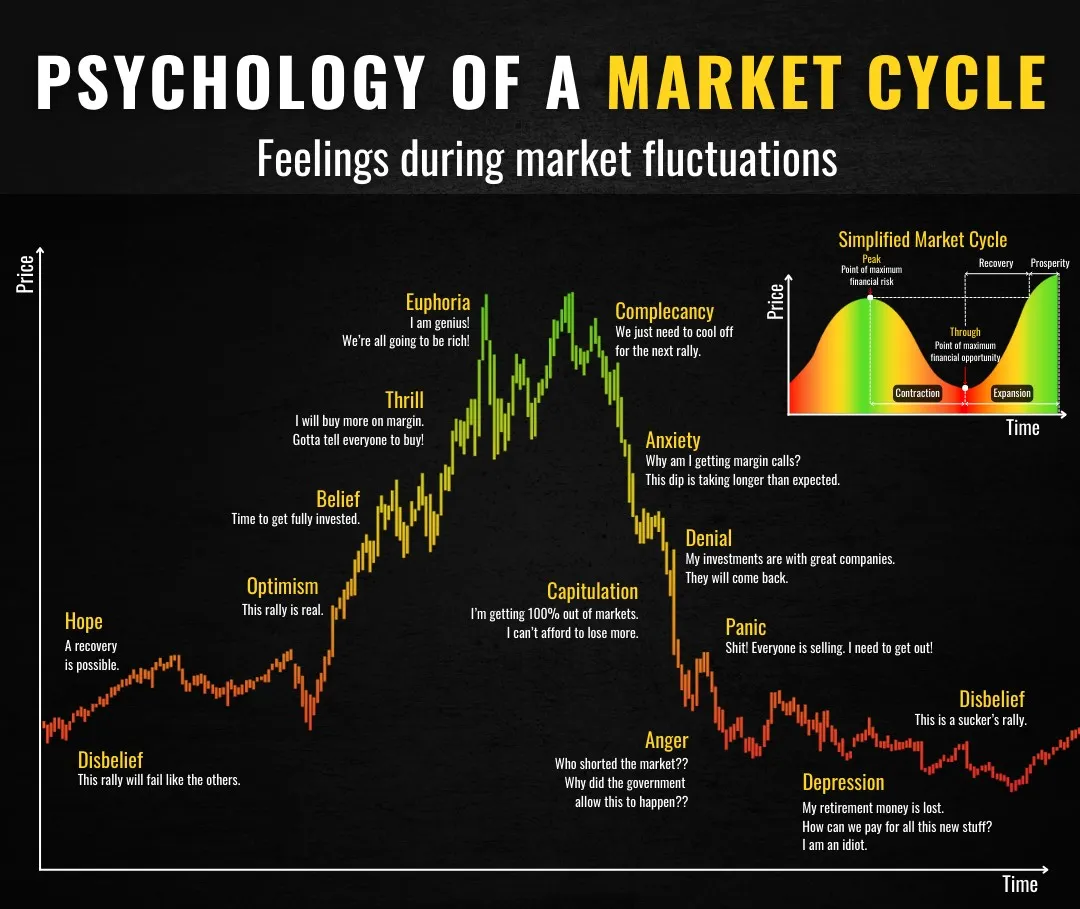

Short-term trading can be enticing due to the potential for quick profits, but it also involves high risk, significant transaction costs, and can lead to emotional decision-making.

Frequent trading requires precise timing and often results in substantial losses.

And I have to admit, I made this mistake back in 2015 when for a short time I got cocky and tried to play earnings and other short term things, and lost $100k+ in under a year.

And of course, you can make that mistake yourself lose money and eventually learn from it, but it might be little easier to learn from my mistake instead and side-step the losing money part 😉 .

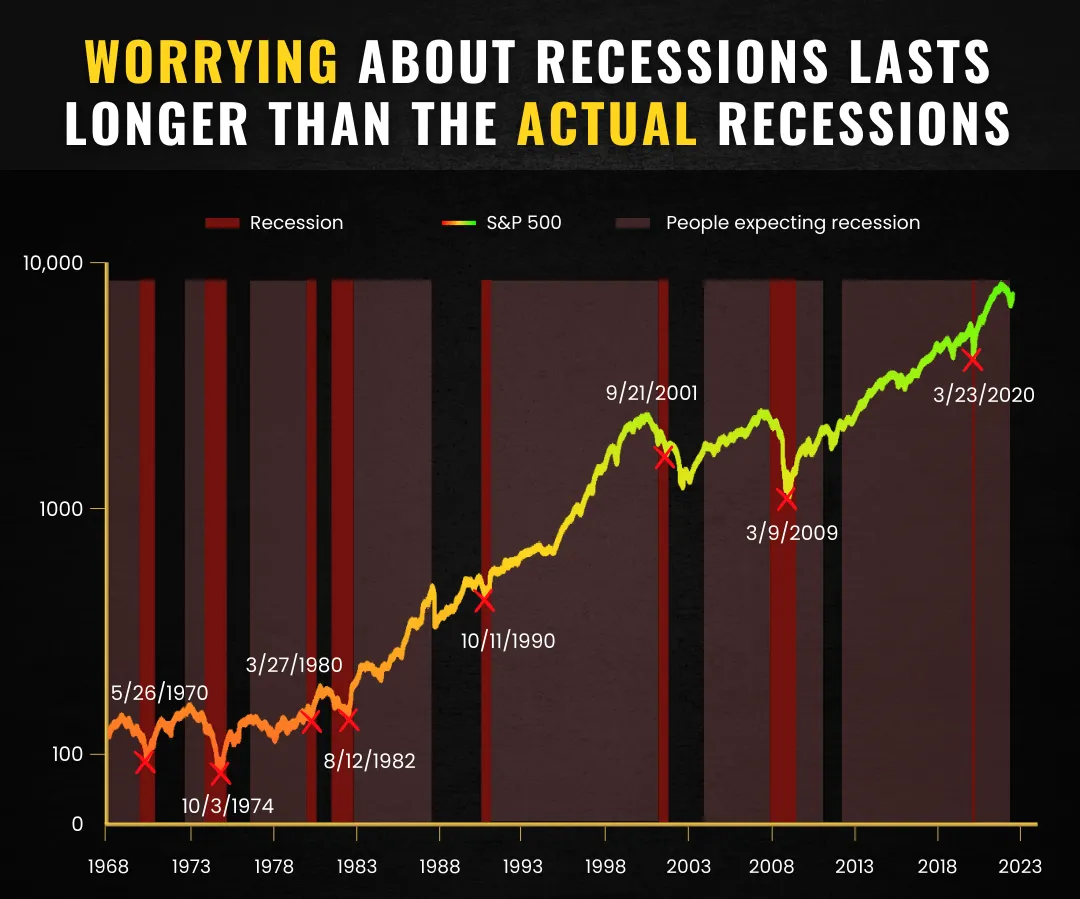

Focusing on long-term investments allows you to benefit from the compounding effect and the general upward trend of the market over time. Long-term investing is less stressful, as it doesn't require constant monitoring of market fluctuations, and it aligns with the fundamental principle that markets tend to reward patient investors who stay invested.

5/ Focus on increasing the amount of shares you own rather than the amount you are up or down 💰

Shifting your focus from the daily fluctuations in your portfolio's value to increasing the number of shares you own leads to more disciplined and effective investing. In the end, your shares are tiny pieces of a REAL BUSINESS. And the business becomes valuable as it becomes more impactful, produces more products or services and creates more value for the world.

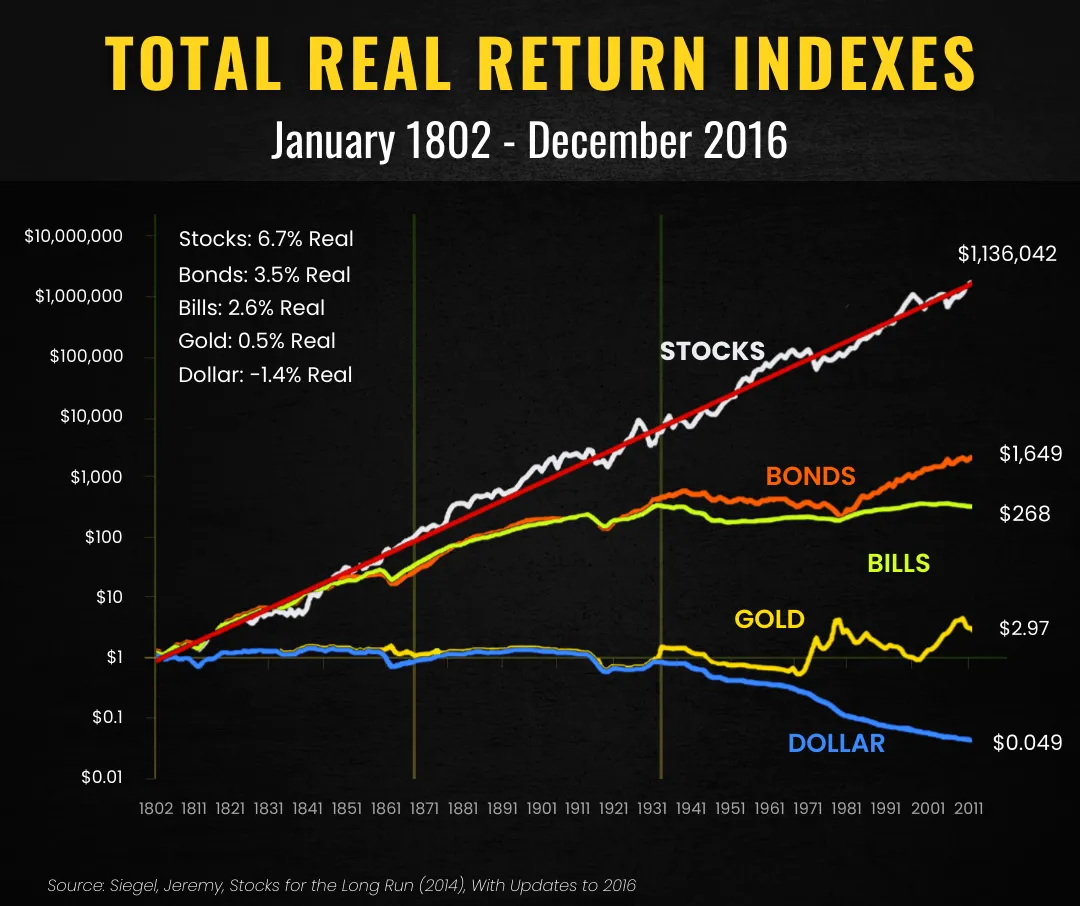

By consistently purchasing shares, especially during market dips, you accumulate assets that grow over time, outpacing bonds, inflation, savings account. They just need to be chosen with care.

This approach encourages a long-term perspective, reducing the emotional impact of short-term market movements. Over time, as these shares appreciate in value, your portfolio grows. This strategy helps investors build a solid foundation for future wealth rather than being swayed by temporary market conditions.

6/ Surround yourself with like minded investors 👨👨👦👦

Being part of a community of like-minded investors can provide valuable support, insights, and encouragement.

These relationships can help you stay disciplined and focused on your long-term investment goals, especially during challenging market periods.

Engaging with others who share your investment philosophy can lead to the exchange of ideas, access to diverse perspectives, and a better understanding of market dynamics. Such a network can also provide accountability, helping you stick to your investment plan and make informed decisions rather than reacting emotionally to market volatility.

7/ Learn from those that have been through crashes 🧠

Gaining insights from experienced investors who have navigated market crashes can be invaluable.

These individuals can offer wisdom on how to manage emotions, maintain a long-term perspective, and identify opportunities during downturns.

Learning from their experiences helps you understand the importance of resilience and the inevitability of market cycles. By studying their strategies and mistakes, you can develop a more robust investment approach, better prepared to handle future market turbulence and capitalize on opportunities that arise during periods of market stress.

Would you love to learn how to recognize GREAT companies, so your portfolio can grow year by year regardless of the market whims?

Apply to join my Private Group and become GREAT investor who can conquer the market!

👇 👇 👇

By subscribing you agree to receive text messages at the number provided. Rates may apply.

Our existing 6/7 figure members!

👇 👇 👇