Jeremy LeFebvre's

First, watch this video!

I've watched the video & ready to join!

Requirements:

1. Committed to mastering long-term investing at a high level.

2. $100,000+ net worth.

3. Aiming to scale to 7/8 figures and beyond.

4. Understanding that becoming competent investor requires dedication and effort.

Jeremy's Private Stock Group has over 700 verified 6-figure members

& over 300 verified 7-figure members

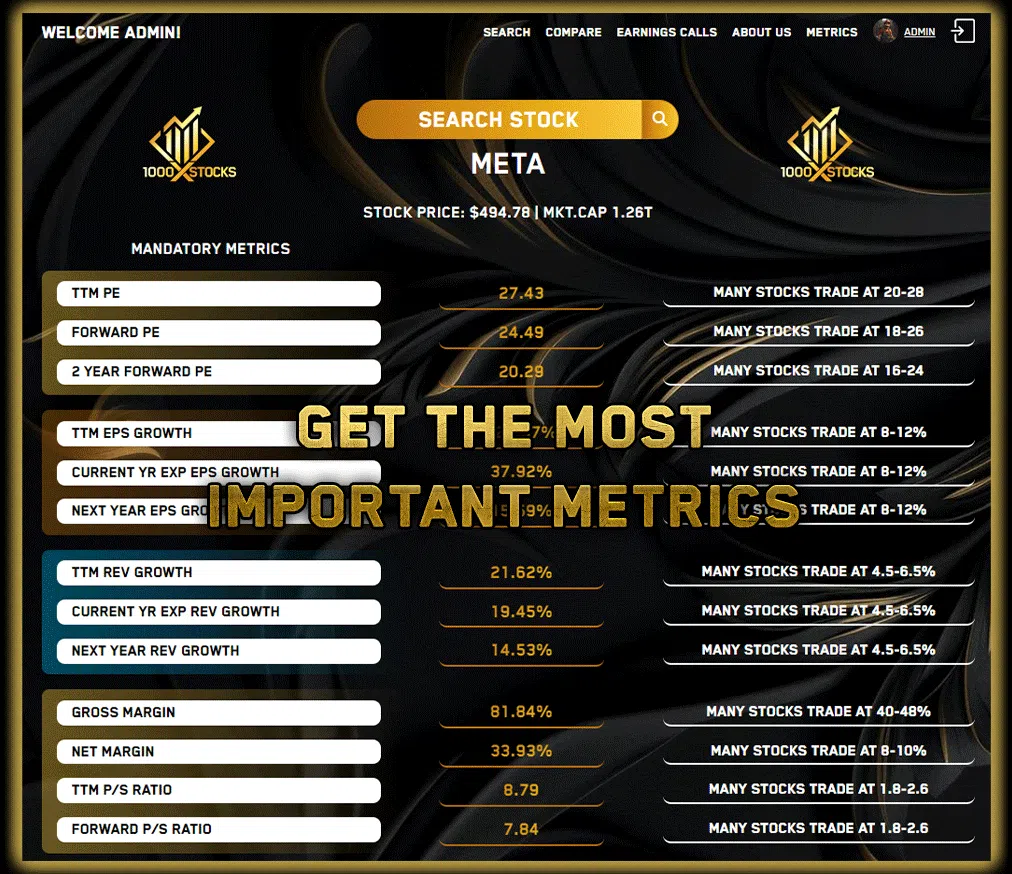

Get the information you need to succeed with 1000X software!

F.A.Q.

What do our Members Say?

For years, alongside @HolySmokas in the Private Stock & Wealth Group, we've built something special—where knowledge, wealth, and happiness align.

" Great information in this group. Very easy to contact the administrators. Ondrej is definitely an asset. I look forward to the future here."

The courses and the community. It's nice to have this as a resource, we help eachother give perspective and updates on research. I've learned from others in the community and it's been a joy. Lastly, 1000x is a helpful tool to conduct my research and made researching companies convenient.

Jeremy‘s private group helped me a lot. Jeremy‘s private group was instrumental in my success. All the video he uploads about Researching companies every week are very helpful.

Get in while you still can. Best investment program and Community on the market For all levels of experience. There’s a lot of great people and programs for everyone who want to become financially independent.

Above all or was the valuable lessons… Above all or was the valuable lessons Jeremy teaches about investing and the confidence you get when you learn to evaluate a company's fundamentals, that help you stay invested even during market downturns.

See more TrustPilot reviews

F.A.Q.

1. How much time is required?

Most of our members should be able to find 3-4hrs a week in order to get strong result. The more time you can commit the better investor you become!

2. How long does it take to become competent investor?

As a result of a survey completed by our members in 2025, members become significantly more confident in investing, understanding the markets and knowing when to buy and sell stocks within 2-3 months.

3. I am a beginner and this sounds too complex - is this for me?

Even though we have many 6/7 figure investors, very often people join in their first few years in the market.

As a good rule of thumb, you should have at least $100k in the market and ability to invest $1000/mo to make the most out of Jeremy's long term investing approach.

4. I am an experienced investor and this sounds too simplistic - is this for me?

We have many 6/7 figure investors with 10+ years of experience as well as hundreds of hours of high-level research. Through the Private Group, people learn how to analyze balance sheet and income statement in more detail.

Additionally, advanced projections, valuation models, and more complex strategies are also part of the curriculum.

5. What topics are covered in the group and what can I learn?

Detailed description will be sent to you after application, but in general our members learn overall portfolio strategy for long-term investing, how to analyze companies both in term of both quality as well as financials. You will learn how to master balance sheet and income statement to recognize opportunities and what potential red flags are hiding there so you can avoid costly mistakes.

Ultimately you will learn long term financial models so you have better clarity on where the companies are headed for the long term and how that gets reflected in the stock price.